Share article

I am going to make a challenge that I am already certain almost none of you will accept. Regardless, I will make the challenge first and then attempt to convince you to actually follow through.

I challenge you to share an idea with your competitors that will help make them more successful. You could share an idea here along with this article, at an industry meeting, or – now, here’s a TOTALLY crazy thought – you could talk with them directly.

I’m guessing many of you are thinking, “He’s lost his freakin’ mind!!”

Sharing good ideas with your competitors is likely the last thing you want to do. However, in the long run, you would actually be helping yourself.

I just returned from the national convention of the National Association of Health Underwriters (NAHU). Of all the conferences I attend, this and NAHU’s Capitol Conference are the only two where people attend for the benefit of something bigger than themselves.

As opposed to going for self-serving reasons, people attend these conferences to give back to an industry that has given so much to them. We need more of that.

If you are a member and have never attended, plan on it for next year. If you aren’t a member, join and attend. The industry needs you and your ideas.

However, even at a NAHU conference, personal fears and insecurities get in the way. During our Town Hall meeting and in the hallways, there were plenty of attendees upset because they felt NAHU isn’t doing enough to prevent carriers from cutting commissions. And, despite the ABUNDANCE of idea sharing that happens via NAHU, I know there are plenty of people who won’t join because they don’t want to be a part of that sharing (at least the giving part).

Stick with me, these ideas are definitely connected.

Protecting commissions does not equal protecting your job

I want to start with the commission protection first and then I’ll come back to the idea sharing. Anti-trust laws aside, why does anyone feel it is up to NAHU (or any other organization for that matter) to force Congress to get involved in the setting/protecting of commissions?

Remember, this is the same Congress we regularly demand stays out of healthcare!!

The insurance carriers are (for now) independent businesses who are allowed to make their own (good or bad) business decisions. I don’t think any agency owner who is demanding the carriers be told how much they must pay in commissions would want anyone controlling his/her business operations in the same way.

Remember, the only reason carriers pay commissions to brokers/agencies is as compensation for the distribution and front-line service they provide to mutual clients. If carriers can distribute less expensively (think online technology), they’re going to. Wouldn’t it be bad business not to?

Brokers/agencies are looking the wrong direction. Instead of looking to someone else to protect commissions from carriers for distributing their product, they need to be looking to the value they bring to business owners.

Are you brokering or enhancing?

And let’s consider the very term “broker”. “Broker”, by definition, is a middleman. In the case of our industry, brokers/agencies stand between business owners and the insurance programs they want to access.

Screw being a middleman! Our greatest protection will result from stepping out of the middle and becoming THE destination; the very relationship business owners WANT to access.

Instead of demanding someone else protect their commissions through legislation, how about if brokers/agencies protect their own revenue by making themselves invaluable to consumers?

Who’s demanding what?

The greatest pressure on Congress to protect the role of the broker, and on carriers to continue providing generous commission schedules, will come from business owners who are willing to fight for the relationship with their broker.

However, and here is the ironic part, if a business owner is receiving real and meaningful value from their broker, they will write the check themselves. Congress and the carriers become a non-issue.

I know there are already brokers out there who have clients willing to fight for their relationship. Unfortunately, there aren’t nearly enough. This is where my original challenge comes back in.

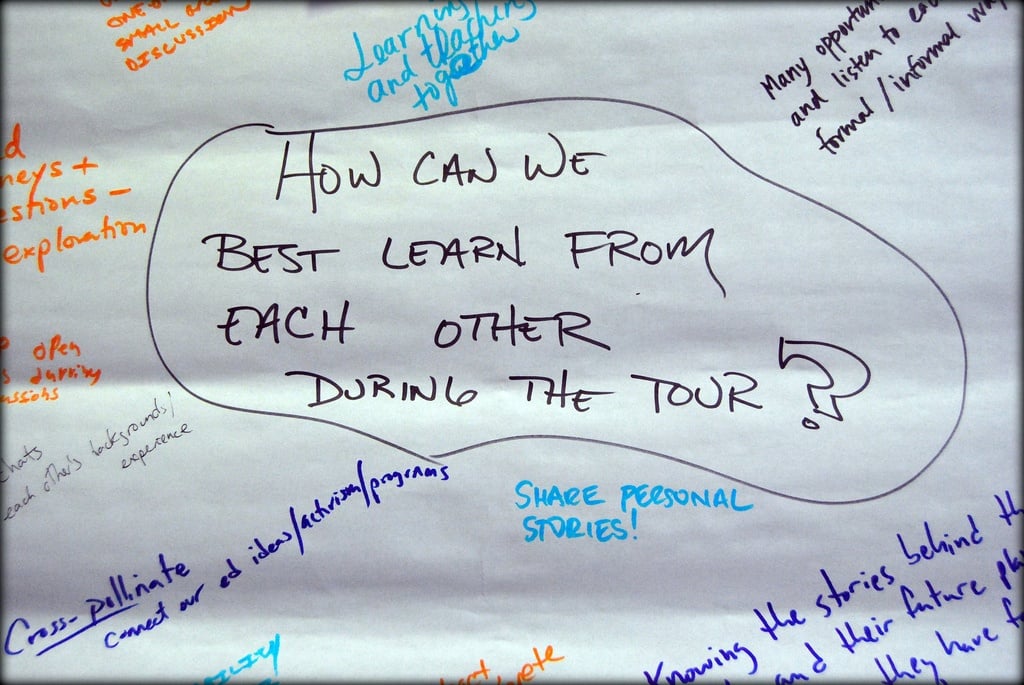

Sharing to grow

If you are one of those rare brokers who is genuinely making a difference in the business lives of your clients (WAY beyond quoting insurance and providing “great service”), you are likely tempted to hold on to your trade secrets. Please reconsider.

If you are the only one in your market who has clients who will fight for you, you may be the last one to go down, but you are still riding on a sinking ship of an industry. You actually NEED to have competitors who bring similar value to their clients; it’s the only way the independent agency system survives.

The independent agency system can only exist as long as it is FILLED with strong independent agencies; agencies whose clients are clearly stronger as a result of the relationship. We MUST grow stronger together.

As the saying goes, a rising tide raises all ships. It is your RESPONSIBILITY to raise the tide by tossing in ideas that will help others become an invaluable resource to their clients. If enough of us accept the challenge, we won’t need anyone to protect us from our own fears and insecurities.

Photo by artfulblogger.