Share article

They suck so bad, you can’t even afford to write that new account.

Do you have any idea of how upside down you are on a majority of your book of business? You may want to make sure you are sitting down for this one.

Knowing that agencies vary significantly by number of producers, let’s do some analysis on a per-producer basis. While the result of a relatively small data base, the new business written and average revenue per client numbers below come from a recent survey of independent agencies. The rest of the numbers are assumptive, but realistic for the industry. Actually, they are definitely on the optimistic side and will paint a more positive picture than likely exists (as hard as that will be to believe by the time you get through them).

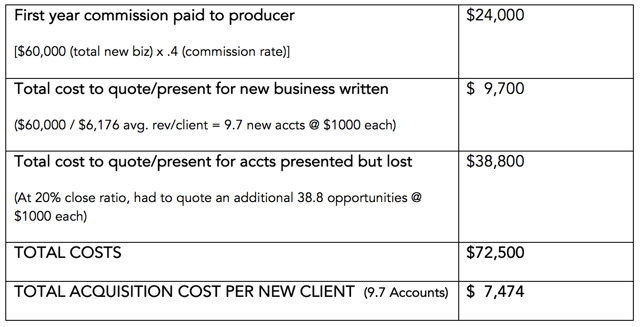

The basis of my calculations:

You are sitting down, aren’t you?

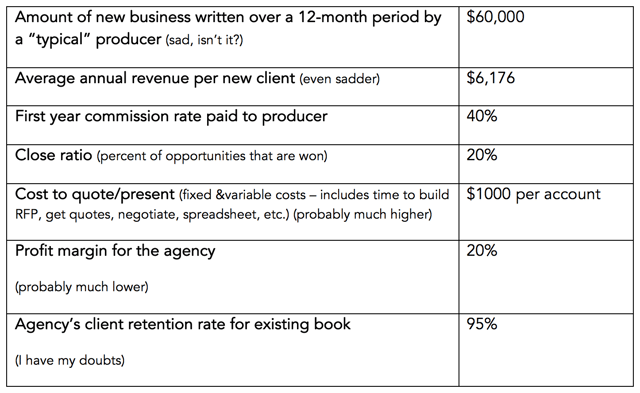

Let’s start by adding up the first-year costs associated with the new business written by a “typical” producer. Meaning, what are the acquisition costs for the total new business written by a producer during a given year?

You may want to lie down for this one.

How long does it take that typical account to become profitable?

- A $6,176 account at a 20% margin generates $1,235 in annual profit or $103/month.

- With an acquisition cost of $7,474 per account, it takes a little over 72 months (6 FREAKIN’ YEARS!!) to turn the account profitable!!

($7,474 acquisition cost / $103 monthly profit = 72 months)

And, imagine where these numbers go if the close ratio is only 10% (and I know it is at times).

Am I being overly harsh with my assumptions?

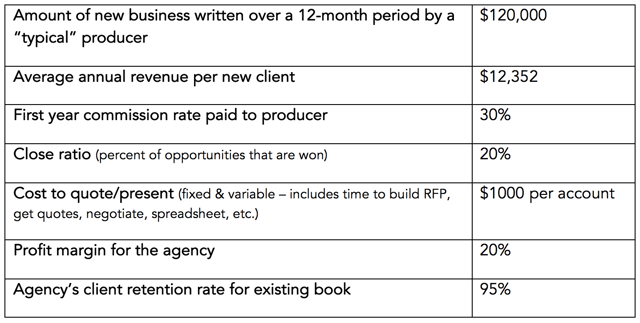

Just for the fun of it, let’s re-run these calculations with some OVERLY generous assumptions. I will double the new business written, double the average client size, and reduce the amount of commission paid to the producer. I already think the other assumptions are overly generous.

Back to the first-year costs associated with the new business written by a “typical” producer

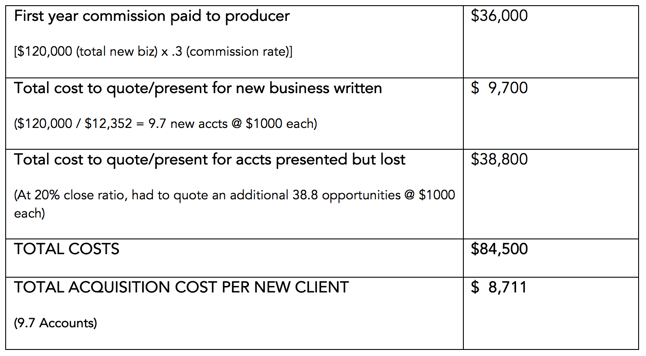

Again, how long does it take for a typical account to become profitable?

- A $12,352 account at a 20% margin generates $2,470 in annual profit or $205/month.

- With an acquisition cost of $8,711per account, it still takes over 42 months to turn the account profitable!!

And, here’s the harsh reality.

- If the account size is smaller, the numbers get worse.

- If your fixed/variable costs to quote are higher, the numbers get worse.

- If your close ratio is lower, the numbers get worse.

- If your profit margin is less than 20%, the numbers get worse.

- If your retention is less than 95%, the numbers get worse.

What can you do?

No doubt, these numbers are shocking. They BEG the question, “How can they be changed?” As you might imagine, it’s not necessarily an easy answer, but there is a more predictable path to profitability.

The only variable over which there is absolute control is the commission paid to the producer. Yet even if the commission rate was dropped to 20% in our second example, it still takes 36 months for an account to turn profitable. And the other variables in this equation are much more difficult to improve.

So, what’s an agency to do to find that more predictable path to profitability?

You must be more intentional in the Marketing and Sales Process

The real answer lies in the way you are approaching the marketing and sales strategy of the agency. The numbers above are the result of an accidental approach to growing your business. Your producers are accidentally finding opportunities and they are accidentally closing a few of them.

It’s time to leave your accidental approach behind and become much more intentional in everything you do. You have to become intentional with your marketing strategy, and you have to become intentional with your sales process.

It’s time for you to develop a marketing strategy that ensures you are getting the attention of the right prospects; it’s time to develop a sales process that more predictably leads to client acquisition; it’s time to deliver a client experience that makes your competition’s pale in comparison.

When these pieces are in place, your producers will find themselves sitting in front of the right prospects, they will be able to convert more of those prospects to clients, you will be able to demand more revenue per client, your acquisition costs go down, and you will turn each account profitable in a much shorter span of time.

Where are you right now?

Be honest with yourself, how effective are your current marketing efforts?

- Have you defined the buyer persona whose attention you seek?

- Are you providing educational content to pique their interest?

- Are you blogging on a regular basis to establish your credibility?

- Are your engaged in social media to participate in the right conversations?

- Are you building premium content as pre-sale examples of your value?

- Are you running campaigns to move prospects through their buyer’s journey?

- Are all the above centered around a clear message that gives prospects a compelling reason/desire to want to meet with you?

If not, you have to start.

Do you have a defined sales process through which you move a prospect?

- Have you abandoned quoting and capabilities presentations as your primary focus?

- Are you helping your clients craft an overall strategy for their HR/Benefit program?

- Are you analyzing the broader aspects (communication, compliance, technology, engagement, etc.) of that HR/Benefit program to help them understand what is currently working for them and what isn’t?

- Instead of asking them to hire you based on a spreadsheet, are you presenting them a longer-term plan of how you will address (with planned implementation of solutions) any deficiencies you identify during analysis?

If not, you have to start.

Clearly, you can’t afford to continue leaving things to chance. Take a deep breath and don’t stand back up too quickly, you’re probably feeling a little light-headed.

Photo by Gunold