Note to readers – You may be surprised to see another post with Zenefits in the title. I want to be very clear - attacking Zenefits is not my intent. Generating some healthy perspective and dialogue in the industry is my intent. I’ve seen and heard many open discussions in the past couple of weeks that I think are very healthy and necessary for everyone, and we all need to keep thinking and talking about these ideas. And if you have followed our writing for any period of time, you know that we have as a primary goal the preservation of our industry, the independent agency system.

Clearly the independent agency system is not perfect, far from it, but it fills a critical need that today’s employers need more than ever before. If you are able to read through the posts with a reasonably objective eye, my hope is that you will see a somewhat balanced criticism of some practices we feel hurt our industry. Yes, I have used Zenefits as a specific example, but I am also quick to point out that they are not alone.

Our goal is not to bash on anyone, but to hopefully start a dialogue that results in the strengthening of this great industry.

____________________________________________________

Don’t let Zenefits drink your milkshake.

. . . Or anyone else for that matter

In a recent post, I made the comment, “If you’re losing business to Zenefits, focus on your business, not theirs.” However, with a competitor as aggressive as they are, it is prudent to be aware of them and not underestimate their ability to “drink your milkshake”.

And, drinking your milkshake is exactly what they want to do, explains Zenefits’ Co-founder/CEO Parker Conrad in a May 15, 2013 Huffington Post interview:

“Insurance companies and their brokers make too much money, he said. ‘We can offer more -- because we make money on the insurance companies -- we are going to drink the insurance broker's milkshake.’ ”

There’s nothing wrong with being an aggressive competitor. I actually admire that mentality. And, I don’t completely disagree that some brokers are overpaid. If all a broker does is get quotes once a year, help fix the inevitable problems, and throw in a round of golf, they probably are overpaid.

However, I am not here to help defend that transactional model against Zenefits. I’m looking to help those brokers who are truly meeting the growing needs of their clients. But, before we talk about how to not only defend against Zenefits, but to perhaps go after their milkshake, let’s gain an understanding of who they appear to be online and in the media.

What business are they truly in?

In response to my recent post, Conrad commented that they got into this business “to help clients through these difficult and complex decisions”. I have to wonder what decisions he is actually talking about.

Zenefits identifies themselves as a tech (SaaS) company. So, if they are referring to the complex decisions of technology, I may buy into that. However, because in many ways they are hiding their technology identity behind the veil of being a broker, their clients are going to expect, and need, help with decisions well beyond technology.

However, a September 20, 2014 article in the New York Times reported that Zenefits didn’t set out to be a health insurance broker at all, but they found that the market could make a lucrative business model.

It seems to me they are nothing more than an accidental broker.

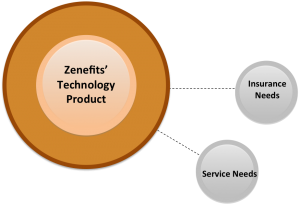

If you were to take the Zenefits business model and create a graphic, at the center of it would be their technology product. Everything else they do is simply to feed the technology beast. And, that’s not my opinion; that comes from Conrad himself. As he was quoted by Business Insider, “the insight in our business model is that if you could be the hub, it’s such a powerful place to occupy that you could make so much money off all of the spokes that you can give the hub away for free”.

The hub of their business is highly concentrated on one need: managing the administrative aspects of HR. So, to whomever that responsibility falls in a company, Zenefits is very attractive. But, given the fact that tech is their hub and benefits is a spoke off of which to make money, employers need to be very aware of what they are giving up in additional value from their current broker in exchange for that technology solution.

What business are you in?

Now, I’m guessing that many of you are feeling a little smug thinking about their business model being focused on a technology product and the holes left by such a myopic focus. Not so fast.

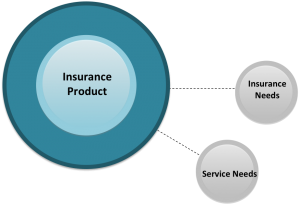

Too many traditional brokers have an insurance product as the hub of their models. If your value proposition is based on quoting insurance and servicing the clients, you are way more similar to the Zenefits model than you likely care to admit.

Too many traditional brokers have an insurance product as the hub of their models. If your value proposition is based on quoting insurance and servicing the clients, you are way more similar to the Zenefits model than you likely care to admit.

The problem for you is that if the decision maker values the technology advice over insurance advice, or when the insurance product becomes increasingly commoditized (fewer choices, no price differentiation, etc.), your milkshake is in jeopardy.

The right business to be in

Depending on any product (technology, insurance, etc.) to serve your needs is dangerous. That approach is only safe until one of three things happen:

- A superior product comes along

- A similar product is offered at a cheaper price

- The ability to distribute that product is taken away

Both Zenefits’ and the typical agency approach are vulnerable to at least two of the three.

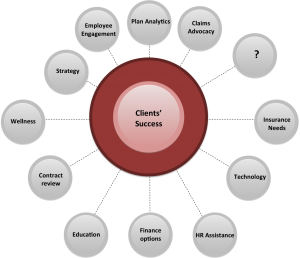

Instead of depending on a product to serve your needs, focus on serving the needs of your clients. No employer out there wants to buy additional products. They see those products as something they have to buy in order to achieve what they really want.

Business owners want to be more successful as a business, and they value those who can help them achieve that success.

The hub of your model should be the client. What do they need and WANT in order to be successful at what they do? EVERYTHING else must surround that hub and exist for the sole purpose of feeding that beast.

Sure, some of the critical spokes to feed that hub are the right insurance products, strong service, and, yes, technology. However, those are just the beginning. The spokes also need to include compliance, engagement strategies, wellness, risk finance advice, HR assistance, etc. Commit to having this approach for your own model and you will be the one the competition fears.

How prepared are they/you to meet the needs of your clients

I’m sure Zenefits is capable of meeting the difficult and complex needs of HR administration. However, when their own job posting for a Benefits Advisor states that successful candidates will be given a “one month crash course”, I have to believe that they are only minimally capable of meeting the difficult and complex insurance needs of today’s employers.

Now, before you get too smug again, how prepared are you to meet the needs of today’s clients? If your model is focused on nothing but insurance needs, you may be able to meet the difficult and complex needs of insurance, but you may be only minimally capable of meeting the other difficult and complex needs of today’s employers.

Some of you may believe that because you have access to non-insurance solutions (you probably call them Value-Added Services) that you’re satisfying those additional needs. However, having them does not mean they are being used effectively to actually meet the additional client needs.

Tired of worrying about your milkshake?

Save yourself – We heard it with ACA, and we’re hearing it with Zenefits in regards to possible rebating. Quit waiting for someone else to step in and save you. Assume nothing will change and commit to making yourself stronger.

Reimagine your business model – Commit to meeting the growing needs of your clients. Of course, you don’t have to meet all of their needs, but the more you are capable of meeting, the stronger your model. And, as I said in my previous post, you will likely need to embrace a collaborative effort with other businesses in order to meet many of those needs. Hint - Starting with a technology solution may be a real good idea.

Have the compensation conversation – I know many of your clients have no idea how much they are paying you. Go have that conversation as fast as you can. That way, when Zenefits comes calling, the client will understand exactly how much “free” is going to cost them financially.

Have the stewardship conversation – You provide great value to your clients, but too few of you ever sit down and review exactly how you have delivered value. Start with a stewardship report and having the strategic conversation about what the client should expect from a broker and your ability/history of having delivered on those expectations. Now when Zenefits comes calling, they will have the right value proposition to measure them against and the limitations of the Zenefits’ offering will be obvious.

Improve the talent on your team - Have the needs of your clients (or their future needs) outgrown the ability of the players on your team? You MAY not need to replace the players on your team, but, at the very least, you better be preparing them to play their game at a new level.

Reinvent your economic engine - The economic model on which you likely founded your agency no longer makes sense. Depending on commissions from the carriers is dangerous. If you are able to help your clients achieve what they truly want - to be more successful - they will willingly write a check.

Get the dollars flowing – Many of the problems you are facing will take an investment of time and/or money. Let me be very clear, you do not have the luxury of sitting on a book of business. Before you focus on anything else, you have to kick your sales activity into high gear – period.

Consider scaling back – You may need to get smaller before you can grow again. If someone on your team isn’t helping you grow, they are holding you back and you need to let them go. And, this also applies to your unprofitable clients.

None of this is easy, but it has to be done. You need it for your own self-preservation, and your clients need it for their businesses almost as much as you do. We sometimes lose sight of what we do as an industry and it’s important to remind ourselves from time to time.

- I recently heard the president of NAHU (a broker himself) read a letter he received from a client acknowledging that without his assistance, a family member would not have gotten the treatment they desperately needed.

- We have clients who work beyond overtime to help clients, their employees and family members through horrendous situations (financial and medical) that most of us cannot relate to.

- A client of ours shared a letter they received from one of their clients thanking them for having figuratively, and literally at times, held his hand as he tried to hold everything together as his wife struggled with terminal cancer.

- I hear brokers talk about the countless hours they spend strategizing with business owners to figure out how the business might be able to continue providing benefits to their employees in a way that allows them to keep their business in tact.

The reality of what an agent does for their clients has to go well beyond the needs addressed by any single product. This is an industry filled with people who make a genuine, profound difference in the lives of their clients. This is an industry that saves businesses and sometimes even helps save lives. This is an industry worth saving itself.

Commit to the hard work it will take to serve the needs of your clients and you will find that your best days are still ahead. You may even find yourself sitting and enjoying a milkshake of your own, courtesy of Zenefits.

If you’re still struggling with how to get started, give us a call. This is the type of agency transformation we are driving at Q4intelligence.

Note: Discussion/Comments on this article are taking place on LinkedIn. Please visit us there to read what others are saying and/or leave your own thoughts.

Photo by Jack Zalium.