Share article

As part of an article I recently wrote for Benefit Selling regarding trends to expect in 2016, I solicited help from a handful of friends I consider among the smartest professionals in the industry. Due to article length constraints, I wasn’t able to share everything, however, they are graciously sharing their ideas here on our blog.

Our next guest blogger in the series is George Reese, CEO of Employee Navigator. They are simplifying the delivery of employee benefits by redesigning the enrollment experience with benefits, HR and compliance software for brokers and their clients.

In George’s own words

Tech platforms

The first, and most obvious, way that technology is changing employee benefits agencies is the adoption of an agency-based technology platform. Brokers need this to fend off competition from payroll providers, Zenefits, and its imitators. While this may seem revolutionary for benefits brokers, P&C brokers have long since had agency management systems.

The first, and most obvious, way that technology is changing employee benefits agencies is the adoption of an agency-based technology platform. Brokers need this to fend off competition from payroll providers, Zenefits, and its imitators. While this may seem revolutionary for benefits brokers, P&C brokers have long since had agency management systems.

Brokers that are going to survive will change their businesses in the following ways:

- Start treating insurance as a commodity

- Provide HR support for technology, including onboarding and payroll

- Develop deeper relationships with fewer carriers

- Sell more lines of coverage to each employee: Think of an insurance agent in the 1970’s – they sold many lines of coverage to each person who was a client. Online systems will make it possible to dramatically increase the number of people serviced per agent.

Technology yields data

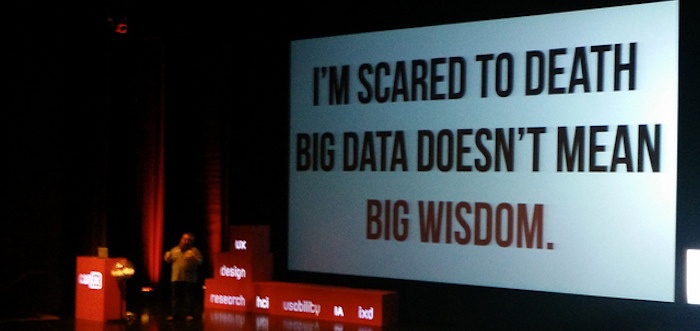

The second, and less obvious, way that technology is changing employee benefits agencies is in using the data collected through these technology systems.

If we start aggregating all of the data, then prospecting for individual insurance sales will never be the same. Think of this: I now have 1.6 million employees and dependents on my platform. I know when someone has a baby and when someone gets a pay raise.

Imagine what happens when I identify the 29-year-old person who has gotten 20% pay raises for the last 3 years. He is the “future high earner” and will develop a relationship with an insurance broker at a much younger age and will eliminate cold calling and other legacy prospecting methods.

Having a system to collect data is step one. Using the data takes agency performance to a whole new level of sales and customer service and even seeing the convergence of the two.

Photo by Mike Gifford.